Travel Tip: Accessing Your Money Without Fees While Abroad

/Spending money is generally very easy, maybe a little bit too easy. But while traveling abroad, there are some common pitfalls you need to avoid, such as foreign transaction fees and ATM withdrawal fees, or else you'll be spending even more money than you need to. This guide will tell you how we access our money while traveling internationally, and so far it has worked very well for us.

Foreign Transaction Fees

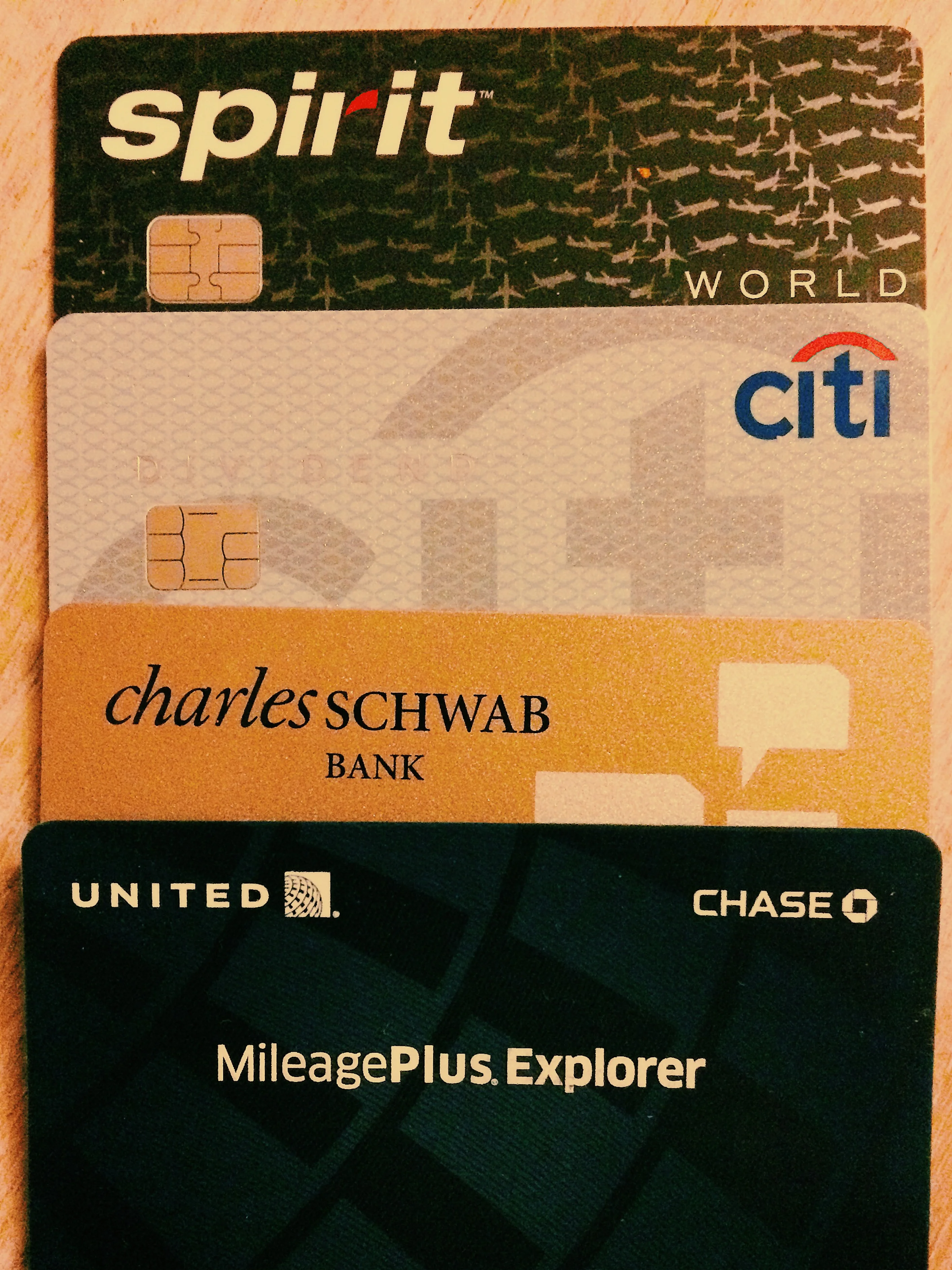

Do your homework about which credit cards are best for international traveling. A number of websites recommended the Chase United MileagePlus Visa, as it does not have any foreign transaction fees. We have been using this as our primary credit card for all of our international expenses, and can definitively confirm we have never been charged even 1 cent for a foreign transaction fee. The only thing not making this a perfect credit card is that it does not offer a chip and pin or chip and signature version.

Chip and Pin / Chip and Signature Credit Cards

While traveling in Europe, you will quickly find that your American credit card is considered a product of the stone age. Europe, in particular France, has aggressively migrated away from traditional swipe cards and towards chip and pin cards, in which the card reader scans the EMV chip embedded in the card and you enter a pin to complete the transaction. Meanwhile, in the US, it seems that is the eventual goal as well, but it doesn't seem to be very popular just yet. Some US banks are beginning to offer more chip cards, specifically chip and signature cards, in which there is no PIN, you just sign like a normal card.

Regardless of all this, your traditional swipe card will still work at most locations, but we have encountered issues a number of times. We have had grocery stores, gas stations, and toll plazas not equipped to take our primitive card, and in these cases we had to use cash since our Chase United card does not have a chip.

We have since gone through our credit cards, and found that our Citi World Mastercard does offer a chip and signature card version for free. We were able to fill out a form on the website to request it, but could not specify to have it shipped to France. Unfortunately, since this card does charge foreign transaction fees, it will just be used as a last resort when we don't have enough cash on hand.

ATMs and Debit Cards

Just like for credit cards, it is important to do your homework about which banks offer the best solution for withdrawing money from foreign ATMs. Our primary checking at home was with TD Bank, something told us we wouldn't find too many of those outside the US, and we were not interested in getting hit with withdrawal fees every time we went to the ATM.

After some research, we found the Charles Schwab High Yield Investor Checking Account. Not only do they not charge ATM fees or foreign transaction fees, but if you get charged a fee by another ATM they will automatically refund you.

There is also a mobile app which Charles Schwab provides. The app has a really useful mobile deposit feature, which allows you to add more money to your account by writing yourself a check from your primary checking account and simply taking a picture of it in the app, without needing to go to any bank. There is a limit to how much money you can write the check for, and it takes a few days to clear, but even still it is a great feature. To use the mobile deposit feature, you do need to be approved, which takes about 3 business days.

There are some slight downsides to the Charles Schwab account. The paperwork is quite lengthy, and it has to be a hard copy (there is no online form), so it shouldn't be something you leave until the last minute before leaving the country. Another caveat is that you have to sign up for their brokerage account in order to get the checking account, but you don't need to keep more than $1 in it if you don't want to.

Overall, the card has been working great for us, and again I can confirm we have never been charged for any ATM withdrawals.